Okay, let’s get into it.

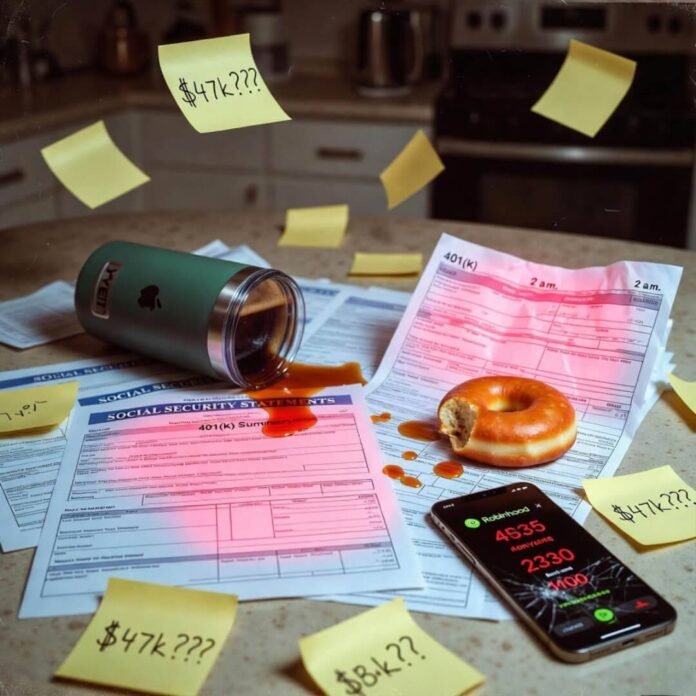

Retirement planning mistakes are literally keeping me up at night in my stupidly overpriced one-bedroom in Austin right now, and I’m not gonna sugarcoat this for you. I’m sitting here in December 2025, heater cranked because Texas can’t decide if it’s winter, wearing the same hoodie I’ve had since Obama’s first term, eating cold leftover Torchy’s tacos, staring at my Fidelity app like it personally betrayed me. And yeah, retirement planning mistakes are 100% self-inflicted in my case.

The First Retirement Planning Mistake That Still Haunts Me: Treating My 401(k) Like a Piggy Bank Retirement Planning Mistakes

I cashed out $47,000—yes, really—when I quit my soul-sucking corporate job in 2016 to “follow my passion” (spoiler: the passion didn’t pay rent). Took the 10% penalty, paid taxes, blew the rest on a food truck that lasted eight humiliating months. That money at a boring 7% return would be worth like $92,000 today. Instead it bought a depreciating taco trailer and a lifetime of regret burritos. Don’t do that. Seriously. Leave it alone. https://www.ssa.gov/benefits/retirement/estimator.html

The Second Retirement Planning Mistake: Ignoring Fees Like They’re Optional Retirement Planning Mistakes

For years I had my money in some American Funds thing with a 5.75% front-end load—because my buddy’s cousin sold it and we grilled steaks together. Paid thousands in fees I didn’t even notice until I finally moved everything to Vanguard in 2021 and saw my actual returns jump overnight. It’s like finding out you’ve been buying $12 lattes when black coffee does the same job. Check your expense ratios, people, I’m begging you.https://www.nerdwallet.com/article/investing/retirement-calculator

The Third Massive Retirement Planning Mistake: Thinking Social Security Will Save Me Retirement Planning Mistakes

I used to look at those SSA statements and think “eh, $2,800 a month, that’s fine.” Bro. Have you bought groceries lately? Gas? Seen what a nursing home costs? I ran the numbers sober for the first time last year and almost threw up in my Whataburger cup. Social Security is a supplement, not a plan. Max out your own accounts first. (Here’s the actual SSA calculator if you wanna cry with me: https://www.ssa.gov/benefits/retirement/estimator.html)https://www.vanguard.com

The Fourth Retirement Planning Mistake I’m Still Making: Lifestyle Creep Is Real and It’s Winning

Made decent money the last few years—finally—and immediately upgraded everything. New truck (stupid), bigger apartment (stupider), daily DoorDash (I hate myself). My savings rate went from 20% to like 6%. I’m literally watching my own future evaporate in real time while eating $18 poke bowls. If your income doubles, act like it went up 30%. Bank the rest. I’m trying to relearn this at 52 and it sucks.

The Fifth Retirement Planning Mistake: Not Having the “What If I Die Tomorrow” Talk Retirement Planning Mistakes

My girlfriend and I avoid this conversation like it’s contagious. No will, no beneficiary updates since 2014, life insurance lapsed because “I’ll do it next month” for 47 straight months. If I get hit by a Tesla on I-35 tomorrow, she gets nothing and my estranged brother gets everything because he’s still listed from when we were close in 2009. Fix your beneficiaries. Today. I’m doing mine right after I post this, swear to God.https://personalcapital.com

Look, I’m not some polished finance guru. I’m just a regular dumbass who’s made every retirement planning mistake in the book—some of them twice—and I’m telling you this from my messy kitchen table at 2 a.m. with heartburn and mild terror. But the good news? You can fix almost all of this stuff starting tomorrow. Retirement Planning Mistakes https://personalcapital.com

Go open a Roth if you qualify. Bump your 401(k) contribution by 1%. Download Personal Capital or whatever and actually look at your numbers. Just don’t do what I did. Retirement Planning Mistakes https://personalcapital.com

You got this. I think. I hope.

Anyway, drop your own retirement horror stories below—I need to know I’m not alone in this dumpster fire.

P.S. If you want a dead-simple calculator that shows how much these mistakes actually cost, play with this one from NerdWallet: https://www.nerdwallet.com/article/investing/retirement-calculator Retirement Planning Mistakes

Now if you’ll excuse me, I’m going to eat another cold queso and update those damn beneficiaries before I’ve been avoiding for half a decade. Retirement Planning Mistakes