Effective tax planning has been a total game-changer for me this year, seriously. I’m sitting here in my messy living room in suburban Chicago—it’s December 2025, snowing outside, my coffee’s gone cold again—and I’m looking at last year’s tax bill thinking, dang, I overpaid big time because I was clueless about effective tax planning.

Like, a couple years back, I freaked out when I owed way more than expected. I was freelancing on the side, had some stock gains, and boom—Uncle Sam hit me hard. It was embarrassing; I told my wife, “Babe, I thought I was smart with money,” and she just laughed. Anyway, I’ve learned the hard way that effective tax planning isn’t some fancy CPA thing—it’s stuff regular folks like me can do to minimize taxes without breaking rules.

Why Effective Tax Planning Feels Overwhelming at First (My Messy Start)

Look, when I first dove into effective tax planning, I procrastinated hard. I’d stare at my pile of receipts on the kitchen table, surrounded by kid toys and takeout boxes, thinking it’ll sort itself out. Big mistake. One year, I missed maxing my IRA and ended up paying extra—felt so dumb. But now? Effective tax planning is just part of my routine, like checking fantasy football scores.

The key is starting early, not in April panic mode. According to the IRS, stuff like retirement contributions can slash your taxable income big time (check their tips here: https://www.irs.gov/taxtopics/tc551). And with 2025 rules, there are even more ways to minimize taxes legally.

2,000+ Financial Stress Stock Photos, Pictures & Royalty-Free …

My Go-To Effective Tax Planning Move: Maxing Retirement Accounts

Hands down, pumping money into retirement accounts is the best effective tax planning trick I’ve used. Last year, I finally maxed my 401(k)—up to $23,500 in 2025, plus catch-up if you’re older—and it dropped my tax bill noticeably. I remember feeling that rush when TurboTax showed the lower number; I was like, “Whoa, this effective tax planning thing actually works!”

If you’re self-employed like part-time me, a SEP IRA or solo 401(k) lets you stash even more. NerdWallet has solid breakdowns on limits. Don’t sleep on this—it’s free money in tax savings.

- Contribute to traditional 401(k) or IRA: Reduces taxable income now.

- Roth options: Pay taxes upfront, grow tax-free—great if you think rates go up.

- HSA if eligible: Triple tax win—deductible contributions, tax-free growth, tax-free medical withdrawals. 2025 limit around $4,300 self-only.

I messed up once by forgetting the deadline; owed more than necessary. Lesson learned.

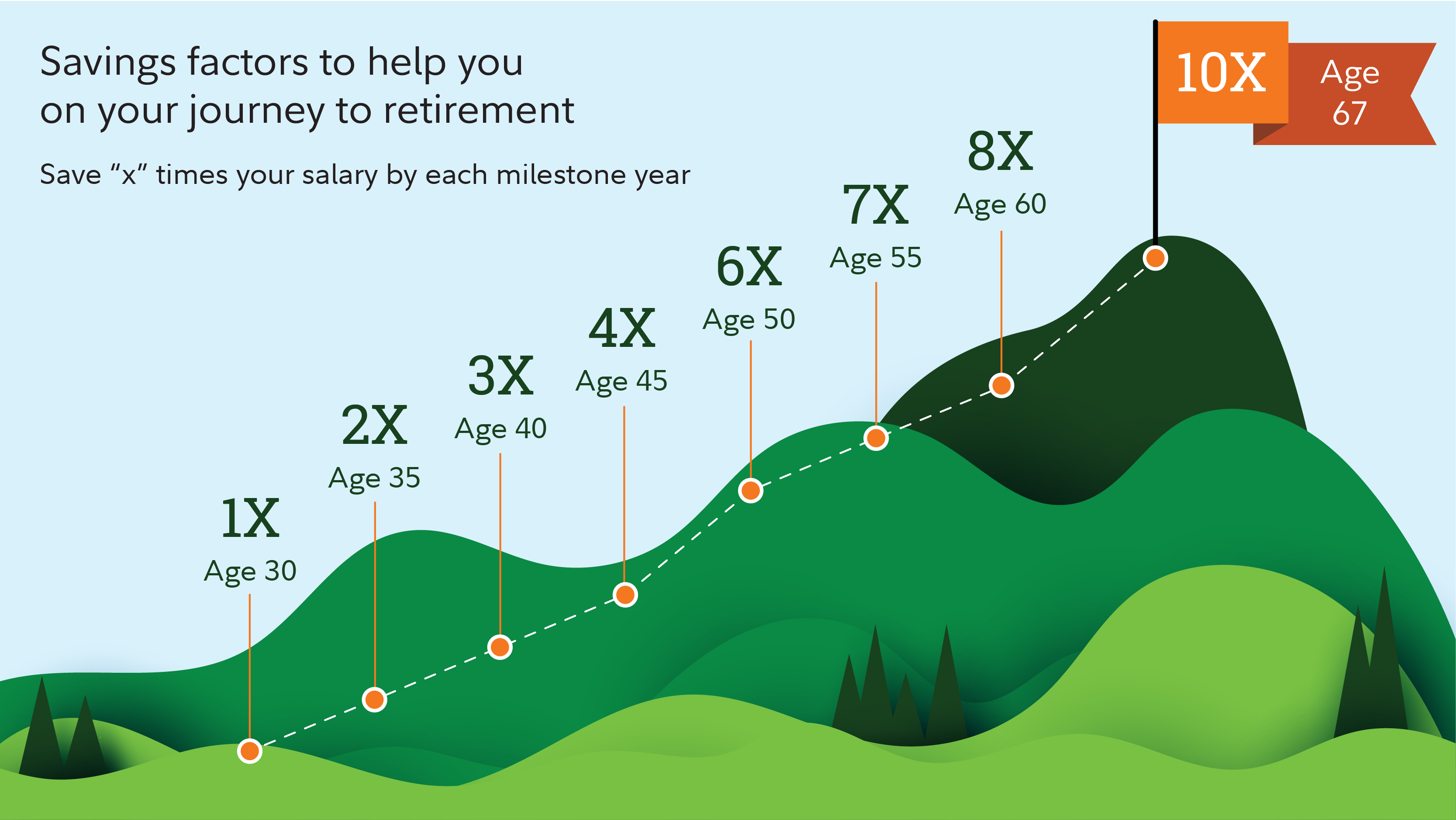

Average retirement savings by age | Fidelity

Charitable Giving as Part of My Effective Tax Planning (The Feel-Good Saver)

Okay, confession: I used to think charitable deductions were for rich people. But bunching donations? Genius for effective tax planning. One year, I donated a bunch of old clothes and cash to local shelters—felt good, and it helped itemize to minimize taxes.

In 2025, you can still deduct if itemizing beats the standard deduction. Donate appreciated stock to avoid capital gains—huge win. Fidelity has tips on this.

My quirky tip: I donate around holidays when I’m feeling generous anyway. Last Christmas, cleared out the garage—tax write-off plus space. Win-win, though I accidentally donated my favorite old jacket. Oops.

4 Smart Ways to Decide How Much to Give to Charity

Year-End Tweaks for Better Effective Tax Planning

December’s my crunch time for effective tax planning. I look at harvesting tax losses—sell losers to offset gains. Or prepay property taxes if itemizing.

Mark your calendar for deadlines; I use my phone now after forgetting once. Schwab has good year-end ideas.

Common screw-up I made: Not tracking everything year-round. Now I snap pics of receipts—saves headaches.

.png)

The All-in-One Financial Planning Calendar

Wrapping This Up (Like Ending a Late-Night Chat)

Anyway, effective tax isn’t perfect—I’ve contradicted myself, procrastinated, made dumb mistakes—but it’s made me less stressed about taxes. I’m no expert, just a regular American trying to keep more of my money while staying legal.

If you’re like me and wanna minimize taxes without the drama, start small: Check your withholdings, max one account, talk to a pro if needed. Hit up IRS.gov for basics or a tax advisor for your situation. You’ve got this—shoot me a comment if something worked for you.

Oh, and if this post devolves into typos or whatever, blame the cold coffee. Later!