Okay, here’s the actual post, straight from me, some dude in a hoodie in New Jersey, December 2025, radiator clanking like it’s personally mad at me.

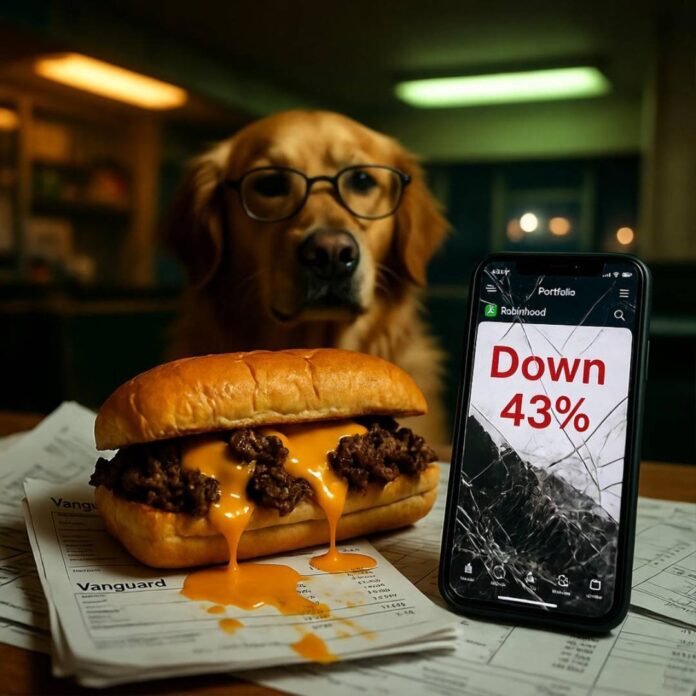

Wealth management tips are honestly the only reason I’m not eating instant ramen for the rest of my life, again. Like, I still remember the exact smell of my 2018 apartment, burnt popcorn and panic, when I put literally my entire tax refund into some random biotech stock because a Reddit bro said it was “going to the moon.” Spoiler: the moon was made of bankruptcy filings. Anyway, fast-forward and I’ve clawed my way into something that resembles successful investing, so I’m dumping everything I actually learned the hard way right here.

Why Most Wealth Management Tips Feel Like They’re Written by Robots in Suits

Every finance bro article is all “compound interest this, index funds that.” Cool, Chad, but I needed someone to tell me you can’t pay rent with compound interest when you’re 28 and your car just died. My first real wealth management tip? Start where you are, even if where you are is broke and drinking gas-station wine out of a coffee mug.

The One Wealth Management Tip That Saved My Ass (Diversification, but Make It Painful)

I used to think diversification meant “buy Tesla and also Dogecoin.” Wrong. 2022 hit and everything I owned turned into a flaming dumpster. Now I’m boring: 70% broad-market ETFs, 20% individual stocks I actually understand, 10% “fun money” that I’m allowed to gamble because otherwise I’ll just do it anyway and lie to myself. VOO, SCHD, chill. That’s it. My portfolio literally smells like beige now and I’m weirdly proud of it.

Successful Investing When You Still Owe Your Mom $400 From 2019

Real talk, I paid off all debt except that $400 because guilt is a powerful asset allocator. Here’s the order that actually worked for me:

- Emergency fund first (I keep six months in a high-yield savings account that I pretend doesn’t exist)

- Max the 401(k) match because free money, bro

- Roth IRA because future me is gonna be taxed into oblivion

- Then, and only then, extra stuff

Pro tip: I named my emergency fund “Don’t Be An Idiot Again” so every time I try to YOLO I literally have to type that phrase. Works 60% of the time.

My Dumbest Money Mistakes (So You Don’t Repeat Them)

- Buying $4,000 of ARKK at the top because Cathie Wood felt like my cool aunt

- Selling everything in March 2020 because the world was ending (spoiler: it didn’t, and I missed the greatest rebound of my lifetime)

- Listening to my cousin who “knows a guy” in crypto

- Thinking “this time is different” approximately 47 times

Wealth Management Tips for People Who Hate Spreadsheets

I use Personal Capital because it’s free and does the math for me while I watch football. Also, every January I sit on the floor with a six-pack and actually read my statements. Takes two hours, hurts like hell, but it’s the adult version of ripping off a Band-Aid.

The Psychology Part Nobody Talks Abo

Turns out I make the worst decisions when I’m either: a) horny b) hangry c) doomscrolling Twitter at 1 a.m.

So I literally set a rule: no buying or selling unless I’ve eaten and it’s between 10 a.m. and 4 p.m. on a weekday. My returns thank me, my dating life… not so much.

Anyway, those are my wealth management tips, raw and unfiltered, from a guy whose net worth crossed six figures for the first time this year and cried in a Target parking lot about it. If I can figure this out while making every possible mistake, you definitely can.

What’s the dumbest money move you’ve ever made? Drop it in the comments. Misery loves company, and honestly, successful investing is 90% not doing stupid shit anymore.

P.S. If you want the boring but actually good funds I use now, here’s my lazy portfolio on Vanguard (not sponsored, I just live here): https://investor.vanguard.com And if you’re ready to track your own mess, Personal Capital is still free: https://www.personalcapital.com

Now go forth and stop being your own worst enemy. Or at least be a slightly richer one.

Top Wealth Management Tips for Successful Investing