Financial wellness has legit been the thing thats kept me from totally freaking out about money lately. I’m typing this on December 15 2025 in my little apartment just outside Chicago, its freezing, the windows are rattling from the wind, and I’ve got this sad leftover pizza slice going cold because I’m too cheap to turn the heat up higher. Financial wellness didn’t hit me like some inspirational quote, more like when I checked my bank account after a weekend trip and realized I’d blown half my rent money on dumb stuff. Like, who spends $80 on bar trivia night? Me, apparently. Super embarrassing but whatever, that’s what finally pushed me.

Why Financial Wellness Actually Helps With Achieving Money Goals

I used to roll my eyes at “money goals” because mine were always these vague things like “save more” or “stop living paycheck to paycheck” but I never knew how. Without financial wellness its all just talk. I had a savings goal jar once, labeled it “vacation fund” and then raided it for takeout like three weeks later. Financial wellness for me is the day-to-day stuff that doesn’t suck too bad—like knowing exactly why I’m broke instead of guessing, or feeling okay skipping happy hour without FOMO killing me.

How I Stumbled Into Financial Wellness (And Screwed Up A Lot First)

Real talk my first try at financial wellness was a complete joke. Downloaded YNAB, watched a million YouTube videos, went full budget bootcamp mode. Made it maybe two weeks before I said screw it and bought new sneakers because my old ones “had a hole.” (They didn’t.) Then I found this blog post on ChooseFI about starting small and it was like oh wait I don’t have to be perfect day one. So I switched to just writing down everything I spent for a month, no changes. Turns out I was dropping $150 easy on random Target runs. Eye-opening and also kinda depressing.

The Random Habits That Somehow Stuck For My Financial Wellness

Stuff that actually worked even though I’m lazy:

- Waiting 24 hours before buying anything fun over $40. Most times I forget about it by then.

- Auto-transferring $75 to savings the day I get paid. I use SoFi because the interest is decent right now (rates change so check here).

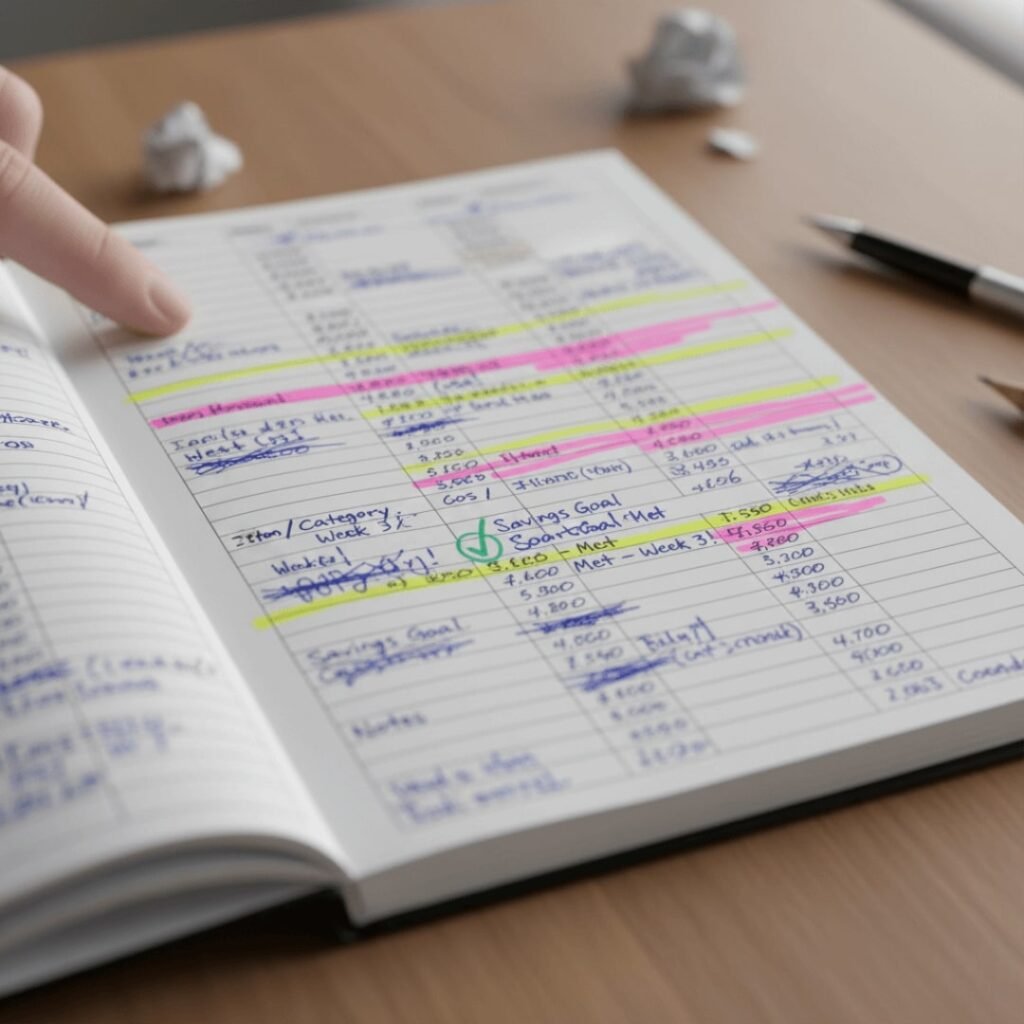

- Sunday night money check-ins with tea instead of wine because wine was getting expensive haha. Just 10-15 minutes looking at the week, moving money around, feeling slightly less doomed.

[Insert Image Placeholder] Quick phone pic of my notebook from last Sunday—coffee spill in the corner, numbers scratched out multiple times, big ugly arrow pointing to “extra $200 to debt!!”

The Part Where Financial Wellness Actually Let Me Hit Some Money Goals

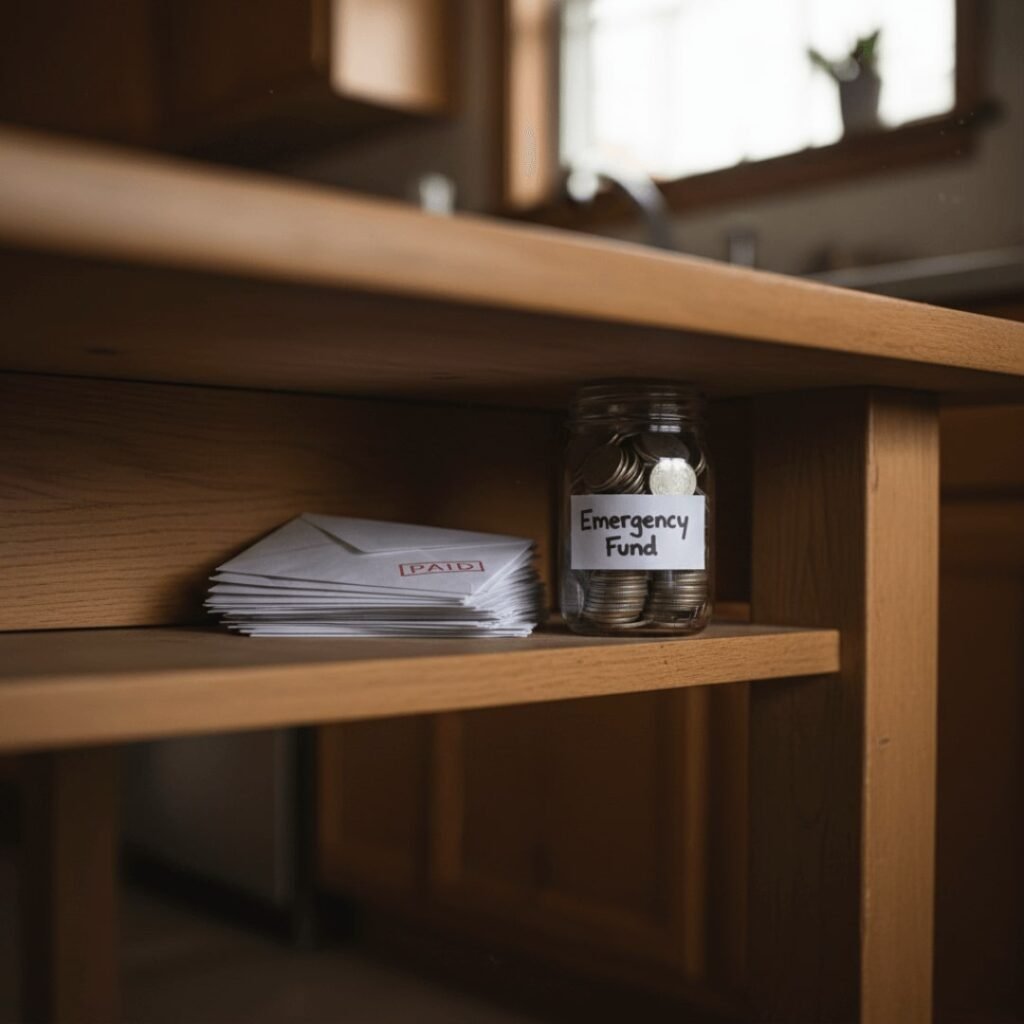

This year I paid off my last credit card from that stupid medical bill back in 2023. Got my emergency fund to three months finally (had to use some when my furnace acted up but I rebuilt it). Even started tossing a little into a Fidelity Roth because everyone keeps saying compound interest is magic or whatever (decent starter guide here). Achieving money goals went from “yeah right” to “huh this might actually happen.”

Obviously I still mess up. Thanksgiving weekend I went overboard on gifts and had to skip a savings transfer. But financial wellness means I didn’t beat myself up for a week straight—I just fixed it next payday.

Anyway I’m Done Rambling

If you’re reading this feeling like your money situation is hopeless, I get it—I was there. Financial wellness isn’t some perfect system; it’s just showing up for your money without hating yourself. Tonight with the snow starting outside my window and my cat judging me from the couch, I’m actually kinda proud of how far I’ve come, messes and all.

What’s one tiny thing you might try this week for your financial wellness? Doesn’t have to be big. Maybe just look at one subscription you forgot about. Or don’t, no pressure. Either way you got this.