Investing can feel overwhelming, but choosing the best investment strategy for your goals is the key to financial success. Whether you’re saving for retirement, a dream home, or a child’s education, your investment strategy should align with your unique objectives, risk tolerance, and timeline. In this guide, we’ll break down how to select the best investment strategy with practical tips, real-world examples, and actionable steps to help you build wealth confidently.

Why Choosing the Best Investment Strategy Matters

Your investment strategy is like a roadmap—it guides your financial decisions and keeps you on track toward your goals. A well-chosen strategy ensures your money works smarter, not harder. For example, Sarah, a 30-year-old teacher, wanted to retire by 55. By selecting a diversified portfolio with a mix of stocks and bonds, she balanced growth and stability, growing her savings steadily over time.

A poorly chosen strategy, however, can lead to missed opportunities or unnecessary risks. Let’s explore how to find the best investment strategy for you.

Step 1: Define Your Investment Goals

The foundation of the best investment strategy starts with clear goals. Ask yourself:

- What are you investing for? Retirement, a new car, or a child’s college fund?

- What’s your timeline? Short-term (1-5 years), medium-term (5-10 years), or long-term (10+ years)?

- How much risk can you handle? Are you comfortable with market fluctuations, or do you prefer stability?

For instance, John, a 40-year-old entrepreneur, aimed to buy a vacation home in 10 years. His medium-term goal led him to a balanced portfolio with 60% stocks and 40% bonds, offering growth with moderate risk.

Actionable Tip: Write down your goals using the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound). This clarity will shape your strategy.

Outbound Link: Investopedia: Setting Financial Goals

Step 2: Assess Your Risk Tolerance

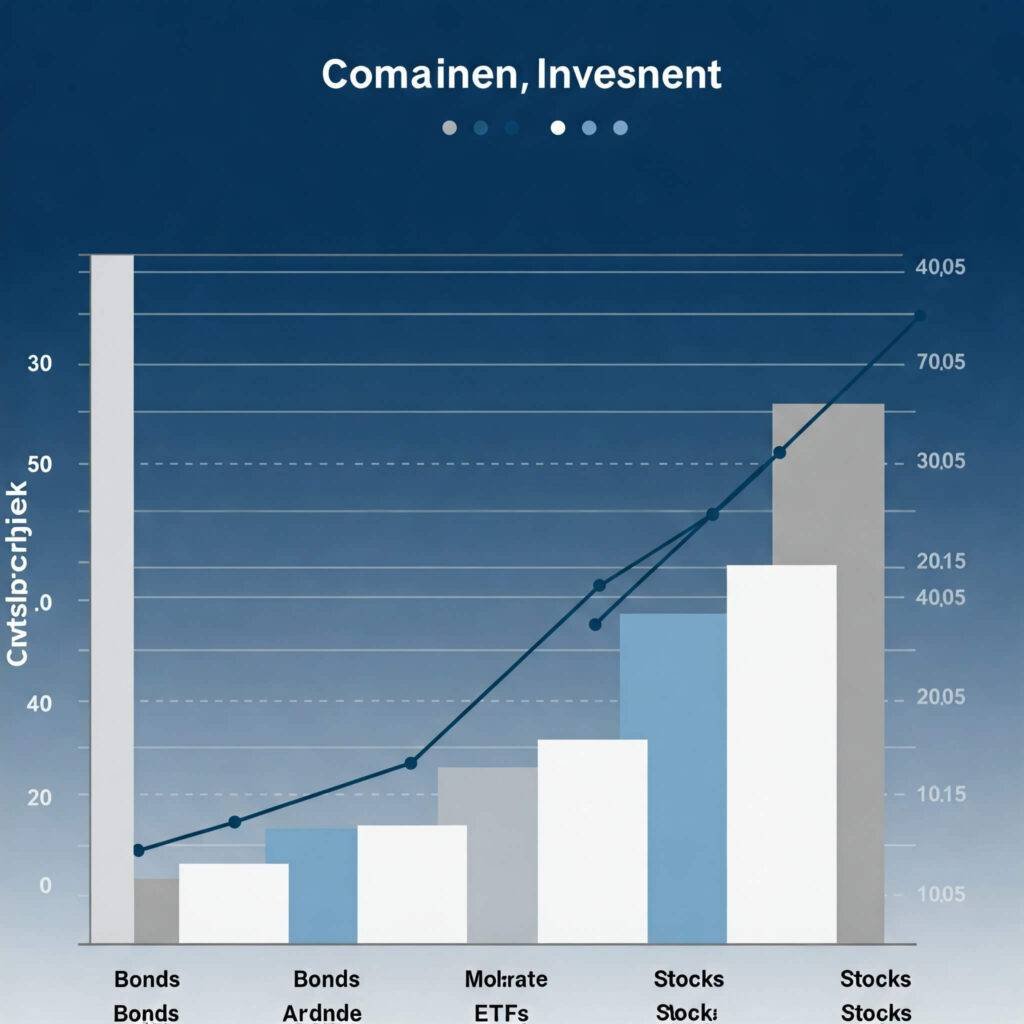

Your risk tolerance is a critical factor in choosing the best investment strategy. Risk tolerance depends on your financial situation, personality, and goals. Here’s a quick breakdown:

- Low Risk: Prefer stability (e.g., bonds, fixed-income funds). Ideal for short-term goals or conservative investors.

- Moderate Risk: Comfortable with some fluctuations (e.g., balanced funds, ETFs). Suits medium-term goals.

- High Risk: Willing to take big swings for higher returns (e.g., individual stocks, cryptocurrencies). Best for long-term goals.

Consider Lisa, a 25-year-old tech worker with a high-risk tolerance. She invested heavily in growth stocks, knowing she had decades to ride out market volatility. In contrast, Mike, a 50-year-old nearing retirement, opted for bonds to preserve his capital.

Actionable Tip: Take a risk tolerance quiz from a trusted source like Vanguard to gauge your comfort level.

Step 3: Explore Investment Options

Once you know your goals and risk tolerance, it’s time to explore investment vehicles. Here are popular options to build the best investment strategy:

- Stocks: High growth potential, higher risk. Great for long-term goals.

- Bonds: Stable, lower returns. Ideal for short-term or conservative investors.

- Mutual Funds/ETFs: Diversified, professionally managed. Suitable for most investors.

- Real Estate: Tangible assets with potential for income and appreciation.

- Alternative Investments: Cryptocurrencies, commodities, or peer-to-peer lending for high-risk investors.

For example, Emma, a 35-year-old freelancer, chose a mix of ETFs and real estate crowdfunding to diversify her portfolio while keeping costs low.

Actionable Tip: Research fees and performance history before investing. Low-cost index funds, like those from Morningstar, often outperform actively managed funds.

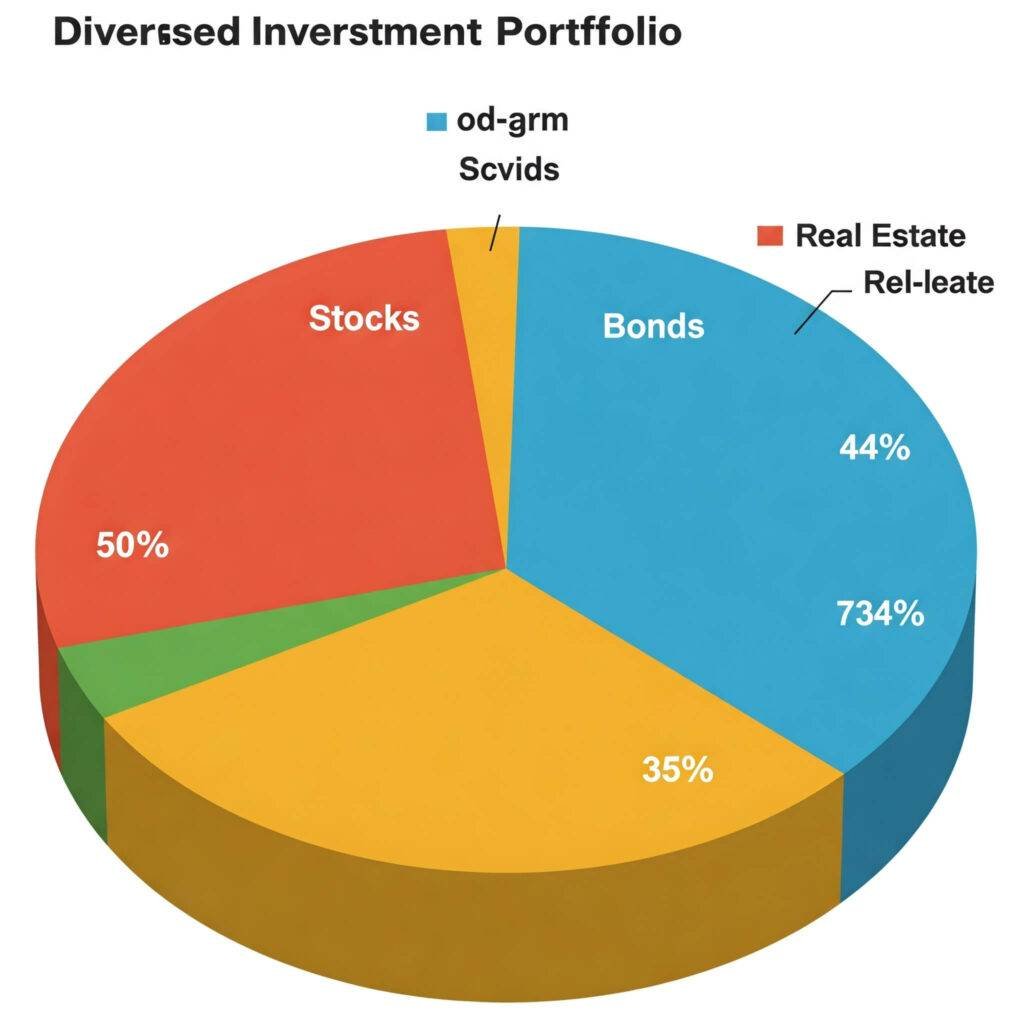

Step 4: Diversify for Stability

Diversification is the cornerstone of the best investment strategy. Spreading your investments across asset classes reduces risk and boosts returns over time. According to a 2023 study by Vanguard, diversified portfolios outperformed single-asset portfolios by 15% over a 10-year period.

How to Diversify:

- Mix asset types (stocks, bonds, real estate).

- Invest across industries (tech, healthcare, energy).

- Consider global markets for broader exposure.

Take Alex, a 45-year-old manager, who diversified his portfolio with 50% U.S. stocks, 30% international ETFs, and 20% bonds. This mix cushioned him during market dips.

Actionable Tip: Rebalance your portfolio annually to maintain your desired asset allocation.

Step 5: Monitor and Adjust Your Strategy

The best investment strategy evolves with your life. Major events—like a new job, marriage, or market shifts—may require adjustments. Review your portfolio at least annually to ensure it aligns with your goals.

For instance, after having a child, Priya, a 32-year-old nurse, shifted her strategy to include more bonds for stability, as her timeline for buying a home shortened.

Actionable Tip: Use tools like Personal Capital to track your investments and net worth in real time.

Common Mistakes to Avoid

Even the best investment strategy can fail if you make these mistakes:

- Chasing Trends: Avoid jumping into “hot” investments like meme stocks without research.

- Ignoring Fees: High fees can erode returns over time.

- Emotional Investing: Don’t sell in a panic during market dips.

Pro Tip: Stick to a disciplined, long-term plan to maximize success.

Conclusion: Start Building Your Best Investment Strategy Today

Choosing the best investment strategy for your goals is a personal journey, but it doesn’t have to be daunting. By defining your goals, assessing your risk tolerance, exploring options, diversifying, and staying disciplined, you can create a strategy that grows your wealth and secures your future. Start small, stay consistent, and watch your investments flourish.

Call to Action: What’s your top financial goal? Share in the comments, and let’s discuss the best investment strategy for you!