Why Financial Consulting Matters for Beginners

Navigating personal finance can feel like wandering through a maze. Whether you’re saving for a house, paying off debt, or planning for retirement, financial consulting for beginners offers a clear path to success. Financial consulting involves working with an expert to create a tailored plan for your money. For beginners, it’s a game-changer—helping you avoid costly mistakes and achieve your financial goals faster. In this guide, we’ll break down how financial consulting works, why it’s essential, and how you can get started today.

What Is Financial Consulting for Beginners?

Financial consulting is a professional service where a financial advisor helps you manage your money, set goals, and make informed decisions. Unlike complex Wall Street jargon, financial consulting for beginners is approachable, focusing on foundational skills like budgeting, saving, and investing. Advisors assess your financial situation, create a personalized plan, and guide you toward long-term success.

Key Services in Financial Consulting

Here’s what you can expect from a financial consultant:

- Budgeting: Learn to allocate your income effectively.

- Debt Management: Create a plan to pay off loans or credit card debt.

- Savings Goals: Build an emergency fund or save for big purchases.

- Investment Guidance: Understand basic investing to grow your wealth.

- Retirement Planning: Start preparing for your future, no matter your age.

Why Financial Consulting for Beginners Is Essential

Without a plan, it’s easy to overspend, miss opportunities, or fall into debt. Financial consulting provides structure and clarity, especially for those new to managing money. According to a 2023 study by the National Financial Educators Council, 65% of Gen Z and Millennials feel unprepared to manage their finances. A consultant bridges that gap, offering expertise and confidence.

Real-World Example: Sarah’s Story

Sarah, a 28-year-old teacher, struggled to save while paying off student loans. She hired a financial consultant who helped her create a budget, prioritize loan payments, and start a small investment account. Within a year, Sarah paid off $5,000 in debt and saved $2,000 for an emergency fund. Financial consulting gave her control and peace of mind.

Benefits of Financial Consulting for Beginners

- Clarity: Understand your financial situation and goals.

- Accountability: Stay on track with expert guidance.

- Customized Plans: Get strategies tailored to your income and lifestyle.

- Education: Learn financial skills to make better decisions.

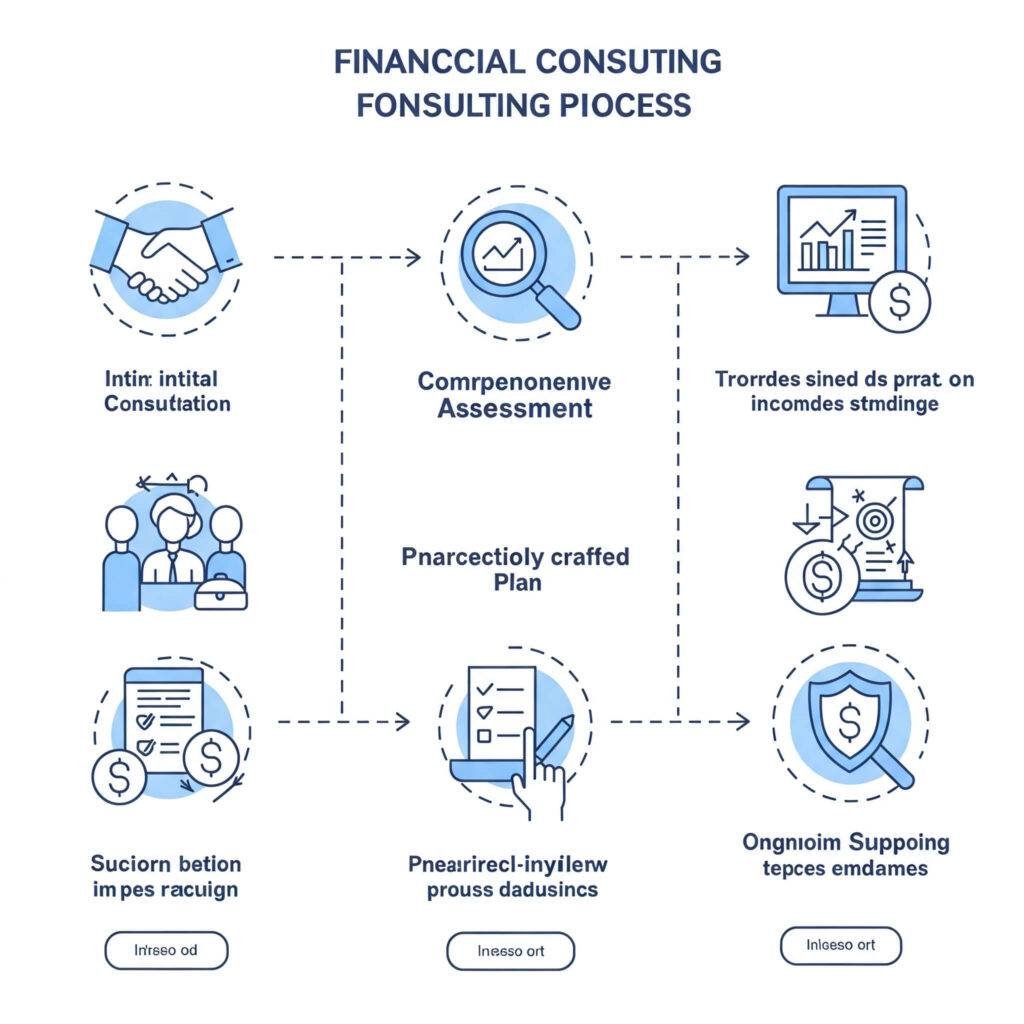

How Does Financial Consulting for Beginners Work?

The financial consulting process is straightforward, even for those with no prior experience. Here’s a step-by-step breakdown:

- Initial Consultation: Meet with an advisor to discuss your goals, income, expenses, and challenges.

- Financial Assessment: The advisor reviews your finances, including debts, savings, and spending habits.

- Customized Plan: Receive a tailored strategy, such as a budget or investment plan.

- Ongoing Support: Regular check-ins ensure you’re progressing toward your goals.

Finding the Right Financial Consultant

Not all advisors are created equal. Look for:

- Certifications: Choose a Certified Financial Planner (CFP) or similar credentialed professional.

- Fee Structure: Understand if they charge a flat fee, hourly rate, or percentage of assets.

- Specialization: Some advisors focus on beginners or specific goals like debt repayment.

- Trust: Pick someone you feel comfortable discussing personal finances with.

For more on choosing an advisor, check out CFP Board’s guide.

Getting Started with Financial Consulting for Beginners

Ready to take control of your finances? Here’s how to begin:

- Set Clear Goals: Decide what you want—pay off debt, save for a trip, or invest.

- Research Advisors: Use platforms like NAPFA to find fee-only advisors.

- Prepare for Your Meeting: Gather documents like bank statements, pay stubs, and debt details.

- Ask Questions: Don’t hesitate to clarify fees, services, or strategies.

- Start Small: Even a single consultation can provide valuable insights.

Actionable Takeaway

Try this today: Calculate your monthly income and expenses to get a snapshot of your finances. Share this with your consultant to kickstart your plan.

Common Myths About Financial Consulting for Beginners

Newcomers often hesitate due to misconceptions. Let’s debunk a few:

- Myth 1: “Financial consulting is only for the wealthy.”

Reality: Advisors work with all income levels, helping beginners build a strong foundation. - Myth 2: “I can manage my finances alone.”

Reality: A professional can spot blind spots and save you time and money. - Myth 3: “It’s too expensive.”

Reality: Many advisors offer affordable options, and the savings often outweigh the cost.

Conclusion: Take the First Step Toward Financial Freedom

Financial consulting for beginners is more than a service—it’s a roadmap to confidence and control. By working with an expert, you’ll gain the tools to budget smarter, save effectively, and plan for the future. Don’t let uncertainty hold you back. Start researching advisors today, set your goals, and take the first step toward financial freedom.