To choose the right financial planner is to take a pivotal step toward achieving your financial dreams, whether it’s retiring comfortably, buying a home, or growing wealth. With countless planners out there, finding one who aligns with your goals can feel overwhelming. This guide simplifies the process with actionable steps, expert insights, and tips to help you confidently choose the right financial planner for your needs.

Why You Need to Choose the Right Financial Planner

The right financial planner is more than an advisor—they’re your partner in navigating complex financial decisions. Choosing the right financial planner ensures your goals are prioritized, helping you avoid costly missteps. A 2023 CFP Board study found that clients with certified planners felt 22% more confident in their financial future.

Step 1: Clarify Your Financial Goals

Before you choose the right financial planner, define your objectives. Are you saving for retirement, managing debt, or investing for your kids’ future? Knowing your goals helps you find a planner with the right expertise.

Questions to Ask Yourself

- What are my short- and long-term financial priorities?

- Do I need help with budgeting, taxes, or investments?

- Am I seeking a one-time plan or ongoing guidance?

Example: Sarah, a 35-year-old teacher, wanted early retirement. She chose a planner specializing in retirement strategies, who built her a tax-efficient portfolio.

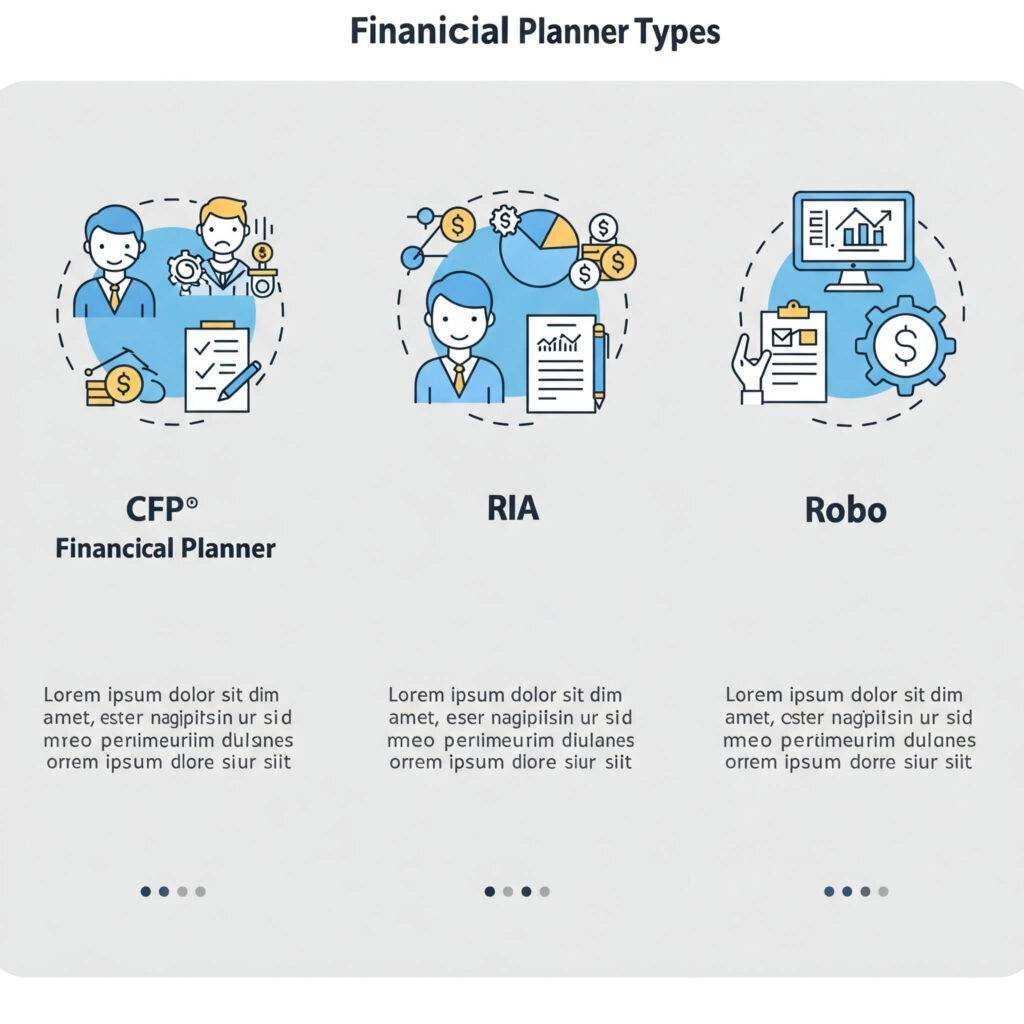

Step 2: Explore Types of Financial Planners

To choose the right financial planner, understand the different types and their qualifications.

Common Types of Planners

- Certified Financial Planner (CFP): Rigorous training, ideal for holistic planning.

- Registered Investment Advisor (RIA): Fiduciaries focused on investments.

- Robo-Advisors: Low-cost, automated platforms like Betterment.

- Traditional Advisors: May earn commissions, so confirm their fees.

Pro Tip: Verify credentials via the FINRA website or CFP Board.

Step 3: Prioritize Fiduciary Duty

When you choose the right financial planner, ensure they’re a fiduciary, legally bound to act in your best interest. Non-fiduciaries may push commission-based products that don’t suit you.

How to Verify Fiduciary Status

- Ask: “Are you a fiduciary?”

- Check their Form ADV on the SEC website.

- Look for CFP or RIA designations.

Step 4: Understand Fees and Compensation

Financial planners charge differently, and clarity on fees helps you choose the right financial planner without surprises.

Fee Structures

- Fee-Only: Paid directly (e.g., hourly or 1% of assets).

- Commission-Based: Earn from product sales.

- Hybrid: Mix of fees and commissions.

Actionable Tip: Request a fee breakdown. Explore fee-only planners on NAPFA.

Example: John, a business owner, chose a fee-only planner for a $2,000 plan, avoiding high-commission products.

Step 5: Assess Experience and Specialization

Experience is key when choosing a financial planner. Seek someone with expertise in your needs, like retirement or small business finances.

Questions to Ask

- How long have you been a planner?

- What’s your experience with clients like me?

- Can you share references?

Data Point: A 2024 Morningstar survey showed planners with 10+ years of experience delivered 15% more tailored advice.

Step 6: Schedule a Consultation

Most planners offer free consultations. Use this to evaluate their style and alignment with your goals.

What to Assess

- Do they explain concepts clearly and listen to you?

- Are they proactive about your finances?

- Do you feel comfortable with them?

Pro Tip: Bring your budget or investment statements to the meeting.

Mistakes to Avoid When Choosing a Financial Planner

- Skipping Credential Checks: Always verify certifications.

- Ignoring Fees: Hidden costs can hurt your wealth.

- Focusing on Personality: Likability isn’t expertise.

- Overlooking Specialization: Ensure they match your needs.

Conclusion: Choose the Right Financial Planner Today

To choose the right financial planner is to invest in your future. By defining goals, checking credentials, and understanding fees, you’ll find a planner who aligns with your vision. Schedule a consultation now and take control of your financial journey.