Investing can feel overwhelming, but with the right investment strategies for beginners, anyone can start building wealth. Whether you’re saving for retirement, a home, or financial freedom, these seven beginner-friendly strategies will help you grow your money confidently. This guide breaks down actionable steps, real-world examples, and expert tips to set you on the path to financial success.

Why Investment Strategies Matter for Beginners

Investing isn’t just for the wealthy—it’s a tool for everyone to grow their money over time. By adopting smart investment strategies for beginners, you can make your money work harder. According to a 2023 Vanguard study, consistent investing in diversified portfolios can yield 7-10% annual returns over the long term. Let’s dive into the top seven strategies to kickstart your wealth-building journey.

1. Start with a Solid Financial Foundation

Before diving into investment strategies for beginners, ensure your financial basics are in place. Pay off high-interest debt (like credit cards) and build an emergency fund with 3-6 months of expenses. This foundation protects your investments from unexpected setbacks.

Actionable Steps:

- Use budgeting apps like YNAB to track spending.

- Save at least $1,000 as a starter emergency fund.

- Pay down debts with interest rates above 6%.

Example: Sarah, a 25-year-old teacher, paid off her $5,000 credit card debt before investing. This freed up $200 monthly, which she redirected to her investments.

2. Invest in Low-Cost Index Funds

Index funds are a cornerstone of investment strategies for beginners because they’re affordable and diversified. These funds track market indices like the S&P 500, offering broad exposure with minimal fees.

Why It Works:

- Low expense ratios (often below 0.1%).

- Historically, the S&P 500 has returned ~10% annually over decades.

- Minimal research required compared to picking individual stocks.

How to Start:

- Open a brokerage account with platforms like Vanguard or Fidelity.

- Choose funds like VOO (Vanguard S&P 500 ETF).

- Invest small amounts regularly via dollar-cost averaging.

Outbound Link: Vanguard’s Guide to Index Funds

3. Diversify Your Portfolio

Diversification is a key investment strategy for beginners to reduce risk. By spreading your money across stocks, bonds, and real estate, you protect yourself from market volatility.

Diversification Tips:

- Allocate 60-80% to stocks, 20-40% to bonds for young investors.

- Consider real estate investment trusts (REITs) for property exposure.

- Rebalance your portfolio annually to maintain your target allocation.

Example: John, a 30-year-old engineer, invested 70% in stocks, 20% in bonds, and 10% in REITs. When stocks dipped in 2024, his bonds cushioned the loss.

Outbound Link: Investopedia on Diversification

4. Embrace Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy for beginners that involves investing a fixed amount regularly, regardless of market conditions. This reduces the risk of buying at a market peak.

Benefits of DCA:

- Smooths out market fluctuations.

- Encourages disciplined investing.

- Ideal for beginners with limited funds.

How to Implement:

- Set up automatic monthly investments in your brokerage account.

- Start with as little as $50 per month.

- Stay consistent, even during market dips.

Example: Emma invested $100 monthly in an index fund. Over 10 years, her $12,000 investment grew to $18,500, despite market ups and downs.

5. Explore Dividend-Paying Stocks

Dividend stocks provide passive income and are a great investment strategy for beginners. Companies like Coca-Cola and Johnson & Johnson pay consistent dividends, which you can reinvest for compound growth.

Getting Started:

- Research companies with a history of stable dividends (e.g., Dividend Aristocrats).

- Use platforms like Robinhood for commission-free trading.

- Reinvest dividends to accelerate wealth-building.

Outbound Link: Morningstar’s Dividend Stock Guide

6. Consider Robo-Advisors for Hands-Off Investing

Robo-advisors like Betterment or Wealthfront are perfect for investment strategies for beginners who want a hands-off approach. These platforms use algorithms to build and manage diversified portfolios based on your goals.

Why Choose Robo-Advisors?

- Low fees (typically 0.25% annually).

- Automated rebalancing and tax-loss harvesting.

- User-friendly interfaces for beginners.

How to Start:

- Sign up with a robo-advisor and complete a risk questionnaire.

- Link your bank account and set investment goals.

- Monitor progress via the platform’s app.

Example: Mike, a 28-year-old freelancer, used Betterment to invest $5,000. In five years, his portfolio grew to $7,200 with minimal effort.

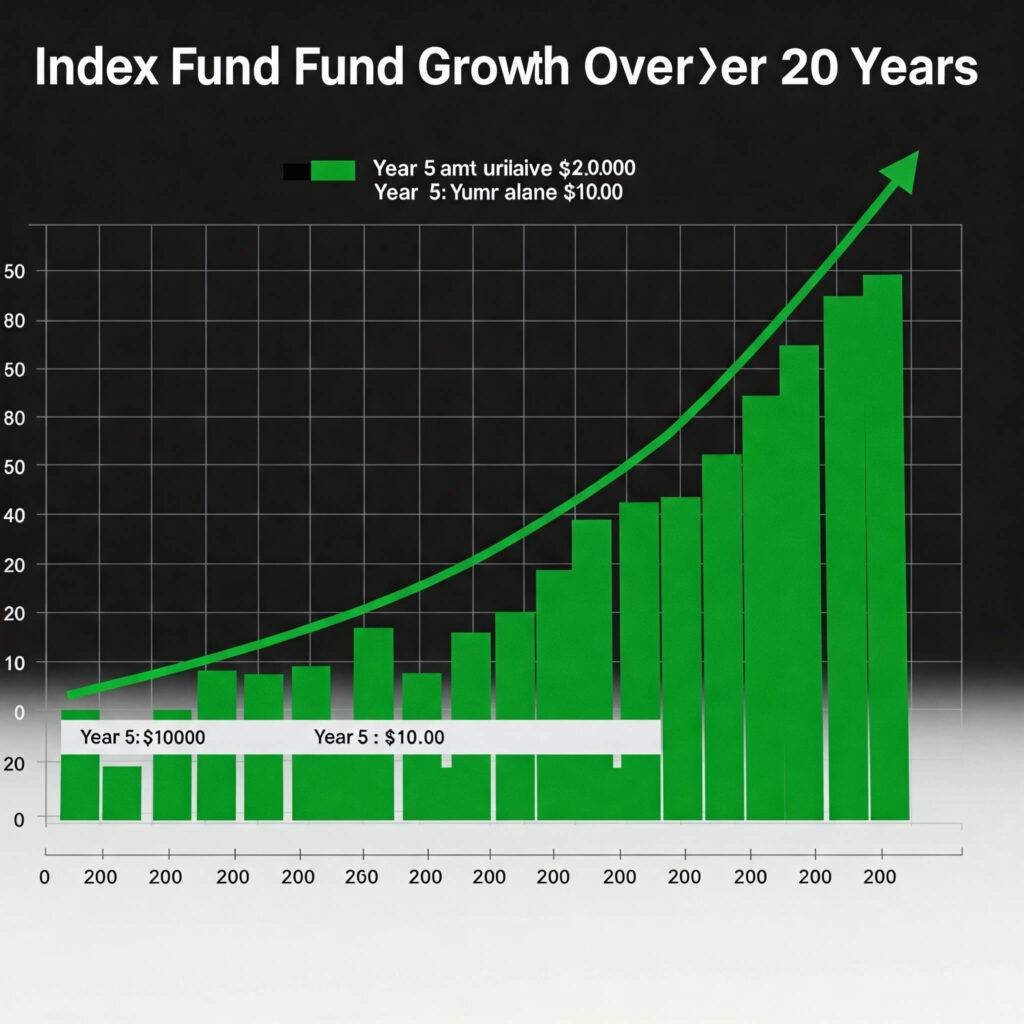

7. Focus on Long-Term Growth

The most effective investment strategy for beginners is to think long-term. Markets fluctuate, but historically, they trend upward. By staying invested for 10+ years, you harness the power of compounding.

Long-Term Tips:

- Avoid panic-selling during market downturns.

- Reinvest all earnings (dividends, interest).

- Review your portfolio annually, but don’t overtrade.

Data Insight: A $10,000 investment in the S&P 500 in 2000 grew to ~$50,000 by 2025, despite recessions, per Bloomberg data.

Outbound Link: CNBC’s Guide to Long-Term Investing

Key Takeaways for Beginner Investors

- Start small, but start now—time is your biggest asset.

- Prioritize low-cost, diversified investments like index funds.

- Use tools like robo-advisors to simplify the process.

- Stay disciplined with dollar-cost averaging and long-term thinking.

By implementing these investment strategies for beginners, you’ll be well on your way to building wealth. Take the first step today—open a brokerage account, invest $50, and watch your money grow!

Outbound links:

- Morningstar: Investing Basics for Beginners

- The Balance: Simple Investment Strategies

- Bogleheads Wiki: Start-Up Investing