Wealth management tips are essential for anyone looking to build and sustain wealth through successful investing. Whether you’re a beginner or a seasoned investor, effective financial planning and strategic investment decisions can pave the way for long-term financial success. In this article, we’ll explore ten actionable wealth management tips, backed by expert insights and real-world examples, to help you achieve your financial goals.

Why Wealth Management Matters for Successful Investing

Wealth management is more than just picking stocks or saving money—it’s about creating a holistic plan to grow and protect your assets. According to a 2023 study by Vanguard, investors with a structured financial plan outperform those without one by an average of 1-2% annually. Proper wealth management ensures your investments align with your goals, risk tolerance, and timeline.

10 Wealth Management Tips for Building Wealth

1. Set Clear Financial Goals

Successful investing starts with defining your financial objectives. Are you saving for retirement, a home, or your child’s education? Clear goals guide your investment choices and timeline.

- Short-term goals: Emergency fund or a vacation (1-3 years).

- Long-term goals: Retirement or wealth accumulation (10+ years).

Example: Sarah, a 30-year-old professional, set a goal to retire by 55. She worked with a financial advisor to create a diversified portfolio, balancing stocks and bonds to achieve steady growth.

Actionable Tip: Write down your goals and review them annually to stay on track.

2. Diversify Your Portfolio

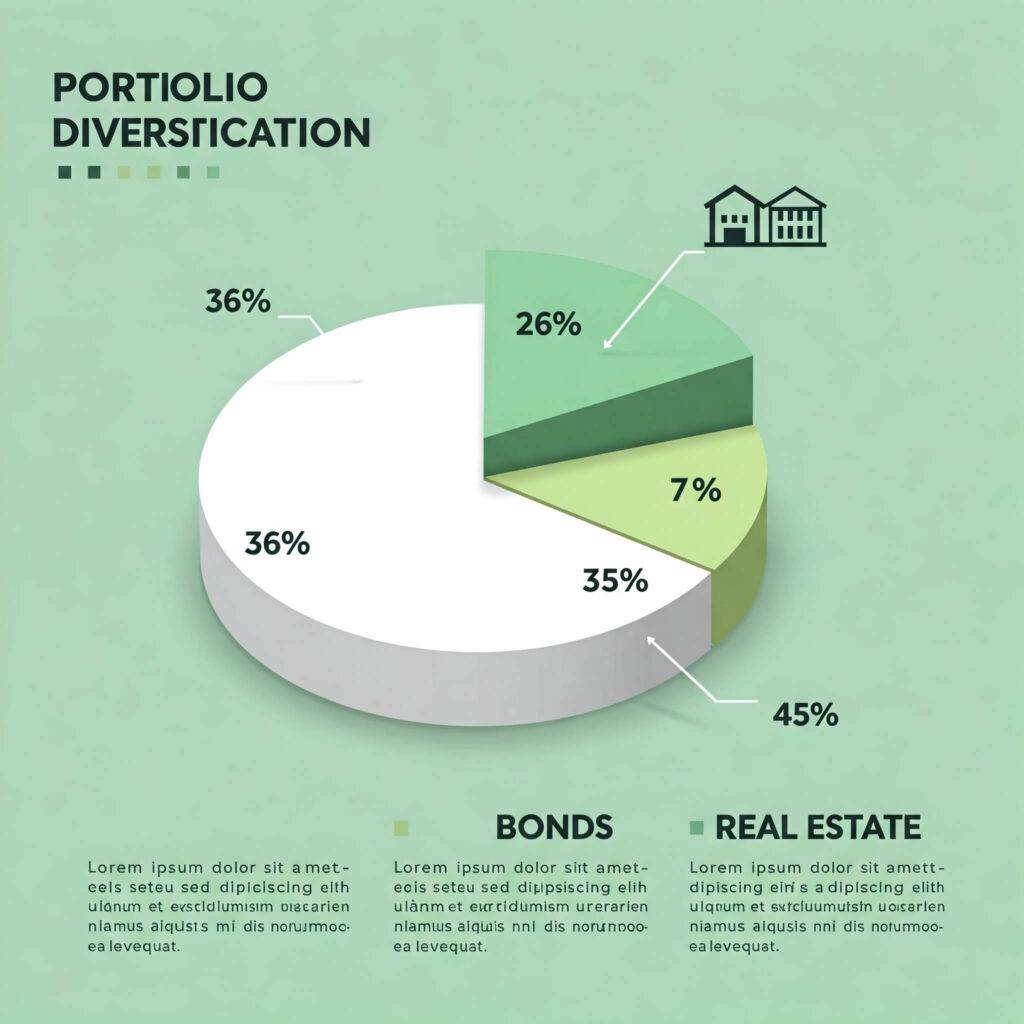

Portfolio diversification is a cornerstone of wealth management tips. Spreading investments across asset classes—stocks, bonds, real estate, and commodities—reduces risk.

- A Morningstar study found that diversified portfolios weather market volatility better than concentrated ones.

- Include low-cost index funds or ETFs for broad market exposure.

3. Understand Your Risk Tolerance

Risk management is critical for successful investing. Your risk tolerance depends on your age, income, and financial goals. Younger investors may lean toward aggressive strategies, while those nearing retirement may prefer conservative options.

- High-risk: Tech stocks, cryptocurrencies.

- Low-risk: Bonds, fixed-income securities.

Actionable Tip: Take a risk tolerance quiz from a reputable source like Fidelity to align your portfolio with your comfort level.

4. Invest for the Long Term

Long-term investing minimizes the impact of market fluctuations. The S&P 500 has delivered an average annual return of about 10% over the past 50 years, despite short-term dips.

Example: John invested $10,000 in an S&P 500 index fund in 2000. By 2025, his investment grew to over $40,000, thanks to compounding.

Actionable Tip: Avoid frequent trading and focus on steady, long-term growth.

5. Work with a Financial Advisor

A certified financial planner can provide personalized wealth management tips tailored to your needs. They help with tax planning, estate planning, and investment strategies.

- Look for advisors with credentials like CFP or CFA.

- Check their track record on platforms like NAPFA.

6. Monitor and Rebalance Your Portfolio

Regularly reviewing your investments ensures they align with your goals. Rebalancing involves adjusting your portfolio to maintain your desired asset allocation.

- Example: If stocks outperform bonds, sell some stocks to restore balance.

- Rebalance annually or after major market shifts.

Actionable Tip: Use robo-advisors like Betterment for automated rebalancing.

7. Minimize Investment Fees

High fees can erode your returns over time. A 1% fee difference on a $100,000 portfolio could cost you $30,000 over 20 years.

- Choose low-cost index funds or ETFs.

- Compare expense ratios on platforms like Morningstar.

Actionable Tip: Opt for funds with expense ratios below 0.5%.

8. Stay Informed About Market Trends

While you shouldn’t chase trends, understanding market dynamics helps you make informed decisions. Follow reputable sources like Bloomberg or The Wall Street Journal.

Example: In 2024, renewable energy stocks surged due to global sustainability initiatives. Investors who researched this trend capitalized on the growth.

Actionable Tip: Subscribe to a financial newsletter for weekly insights.

9. Leverage Tax-Advantaged Accounts

Maximize contributions to accounts like 401(k)s, IRAs, or HSAs to reduce your tax burden and boost wealth growth.

- 401(k): Employer-sponsored plans with potential matching contributions.

- Roth IRA: Tax-free growth for retirement.

Actionable Tip: Contribute at least enough to get your employer’s 401(k) match.

10. Stay Disciplined and Patient

Successful investing requires discipline. Avoid emotional decisions during market downturns, and stick to your plan.

Example: During the 2020 market crash, investors who held their positions recovered losses by 2021, while panic-sellers locked in losses.

Actionable Tip: Create an investment policy statement to guide your decisions.

Conclusion: Start Applying These Wealth Management Tip Today

Wealth management tips empower you to take control of your financial future. By setting clear goals, diversifying your portfolio, and staying disciplined, you can achieve successful investing and long-term wealth growth. Start with one or two strategies from this list, and gradually build a robust financial plan.

For more personalized advice, consult a financial advisor or explore resources from trusted platforms like Vanguard or Fidelity.

Outbound link: