Asset allocation is key to successful investing, shaping your portfolio’s performance over time. By spreading investments across asset classes like stocks, bonds, and real estate, you balance risk and reward. This blog dives into why asset allocation matters, how to implement it, and actionable tips to build a strong portfolio. Learn more about building wealth through smart investing on our site.

What is Asset Allocation and Why is it Key?

Asset allocation involves dividing your portfolio among different asset classes to manage risk and optimize returns. It’s not about chasing hot stocks—it’s about creating a diversified mix that suits your goals. According to Vanguard’s research, asset allocation drives over 90% of long-term portfolio performance, far more than stock picking or market timing.

For example, during the 2008 market crash, investors with diversified portfolios (stocks, bonds, cash) lost less than those heavily in stocks. Read our guide to diversification for more insights.

Benefits of Asset Allocation as the Key to Success

- Lowers Risk: Spreading investments reduces the impact of one asset’s poor performance.

- Boosts Returns: Captures gains across market conditions.

- Matches Goals: Aligns with your timeline, like retirement or buying a home.

- Simplifies Decisions: Offers a clear strategy, reducing emotional investing.

How to Create a Key Asset Allocation Strategy

Building a portfolio where asset allocation is key requires planning. Here’s how to do it effectively, inspired by advice from Morningstar.

1. Define Your Goals and Risk Tolerance

Your allocation depends on your objectives and comfort with risk. A young investor might favor stocks for growth, while retirees may prefer bonds for stability. For instance, Lisa, 35, allocates 70% to stocks, 20% to bonds, and 10% to real estate. Meanwhile, Tom, 65, chooses 40% stocks, 50% bonds, and 10% cash. Explore our retirement planning tips for more.

2. Diversify to Make Asset Allocation Key

Diversification is central to asset allocation. Spread your investments across:

- Stocks: High growth, higher risk.

- Bonds: Stable income, lower risk.

- Real Estate: Income and diversification via REITs.

- Cash: Liquidity and safety.

3. Rebalance to Keep Asset Allocation Key

Market shifts can skew your portfolio. Rebalancing restores your target mix by selling overperforming assets and buying underperforming ones. For example, if stocks rise from 60% to 75% of your portfolio, sell some to realign. Experts like Bogleheads suggest rebalancing annually. Tools like Betterment can automate this.

4. Factor in Your Investment Horizon

Your time frame shapes your allocation. Long-term investors can lean into stocks, while short-term goals need stability. A 20-year horizon might mean 80% stocks, 20% bonds; a 5-year horizon could be 50/50. Check our investment horizon guide for details.

Popular Asset Allocation Models for Success

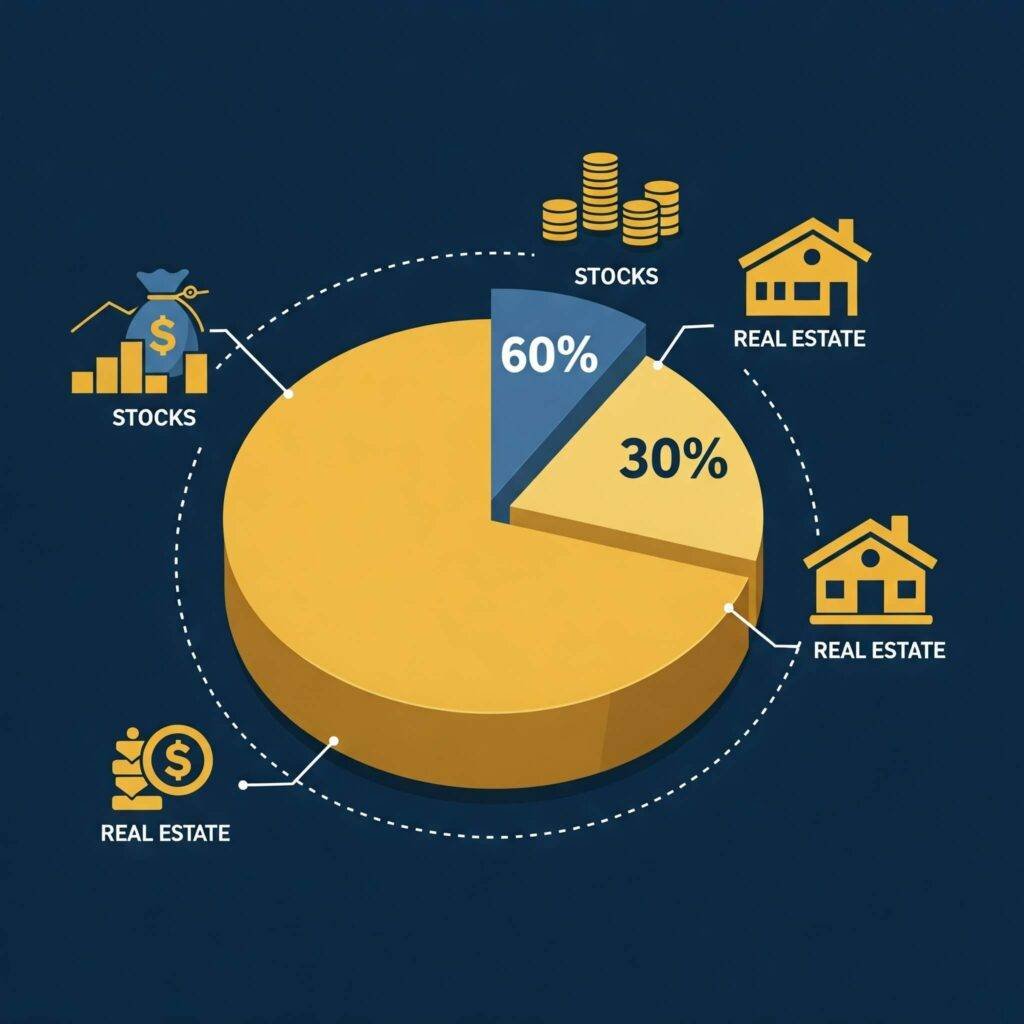

Here are three models where asset allocation is key, suited to different risk levels:

- Aggressive: 80% stocks, 15% bonds, 5% cash (young investors).

- Balanced: 60% stocks, 30% bonds, 10% real estate (moderate risk).

- Conservative: 40% stocks, 50% bonds, 10% cash (retirees).

Avoid These Asset Allocation Mistakes

Even with asset allocation as the key, pitfalls happen. Here’s how to dodge them:

- Overconcentration: Don’t overload one asset class.

- Skipping Rebalancing: Adjust regularly to maintain your mix.

- Chasing Trends: Avoid trendy assets without strategy.

- High Fees: Choose low-cost funds, as advised by Investopedia.

Actionable Tips to Make Asset Allocation Key

To leverage asset allocation, try these steps:

- Start Now: Early diversification fuels growth.

- Choose Low-Cost Funds: Use Vanguard ETFs for affordability.

- Automate Rebalancing: Platforms like Betterment simplify this.

- Review Yearly: Adjust for life or market changes.

- Stay Consistent: Stick to your plan despite volatility.

Learn more in our portfolio management guide.

Conclusion: Asset Allocation is Your Path to Investing Success

Asset allocation is key to successful investing, helping you manage risk, capture growth, and achieve your goals. By diversifying, rebalancing, and avoiding mistakes, you’ll build a portfolio that thrives. Start today and make asset allocation your investing superpower.

Outbound link: